Thoughts from Microsoft Inspire 2019 announcements

Microsoft Inspire (formerly Worldwide Partner Conference, or WPC) was held in Las Vegas in mid-July. I didn’t attend, as the event overlaps heavily with the Finnish summer holiday season, where Finland practically shuts down between midsummer’s eve (late June) to early August.

Thankfully Microsoft is doing a tremendous job in sharing the news and announcements that were made during Inspire. It’s also the start of Microsoft’s new fiscal year; thus, it’s an optimal time for Microsoft to tweak, fine-tune, and change partner incentives, licensing plans, and other partner-related practices.

Instead of merely recapturing what was announced, I wanted to dive a bit deeper and think about what the announcements and initiatives mean for Microsoft Partners. I’ll keep the focus on partners specifically because the other significant events (Ignite and Build) provide plenty of technical excitement to keep us busy the rest of the year.

Many of the sessions are already available for streaming, as well as all the keynotes (“corenotes”). You can access the recordings for free here.

Partner competencies

New partner competencies were announced, specifically the security competency for Azure and Microsoft 365, and five new specialization competencies for Azure (Windows Server and SQL Server Migration to Azure, Linux, and Open Source Databases Migration to Azure, Data Warehouse Migration to Azure, Modernization of Web Application in Azure and Kubernetes on Azure). You can review details on the specialization competencies here.

The security competency is available in silver and gold. The requirements list the general certification requirements (1 * MS500 or AZ-500 for silver, and 4 * MS500 AND AZ-500). Also, a demonstrated customer performance must be met, and these, I think, might be challenging for many partners.

For security competency (silver), a partner company needs 1000 activeMicrosoft 365 security workloads users, or $500/month Azure committed revenue for Azure security workloads. For security competency (gold) this goes up to 4000 active users or $1000/month Azure committed revenue for Azure security workloads. These are challenging numbers to reach, especially if a partner is more heavily geared towards Microsoft 365 security workloads, as this might mean upselling the E5 plans for customers. This has historically been challenging and continues to be so.

The specialization competencies are earned on top of an existing gold competency. Therefore, if a partner company already has a gold competency in something Azure related, it makes sense to try and reach a specialization competency on any of the Azure-related additional options. The specialization competencies do not incur additional fees, except for certification exams that individuals must pass.

My recommendation: Partners who are serious about security is first to attain the new Security Competency. While the gold competency requirements are challenging, they are still perfectly doable, and in its early days, this new competency is undoubtedly going to stand out from the sea of other gold competencies. For partners working in the Azure space, the new competencies seem attractive, but I have my doubts whether customers realize or make any differentiation if a partner has this or that Azure competency – as long as they work in Azure, it’s mostly the same for many clients.

Azure Lighthouse

Azure Lighthouse was also announced. I wrote about this new service last week, and to paraphrase myself; it’s a service that “brings better management capabilities and flexibility for managing multiple Azure tenants through delegated access,” and it’s intended mainly for Managed Service Partners (MSPs).

Azure Lighthouse is impressive for several reasons. Microsoft partners – of all sizes – can now more effectively package and deliver their offerings globally. This way a partner does not need to create a new service, but rather provide a service – such as managing a customer’s Azure tenant or their security stance – and Azure Lighthouse provides a meaningful and lightweight approach for handling this.

My recommendation: Microsoft partners, especially MSPs, should learn the ins and outs of Azure Lighthouse, and then start packaging and offering services either through public or private Azure Marketplace channels. As the service itself is free, this is an easy decision and something that all partners working in Azure space as MSPs should consider.

You can view details for Azure Lighthouse here.

New opportunities for Business Applications partners

Dynamics 365 and Power Platform (Microsoft Flow, PowerApps and Power BI) were often mentioned during Inspire, and it’s evident as they are both growing at a rapid pace, and provide immediate benefits for customers.

Microsoft announced during Inspire that they’d launch a new program for Business Applications partners, and there is going to be a new Business Applications ISV Connect Program.

Let’s look at the ISV Connect Program first – you can find more details on the program here. The guideprovides even more context and guidance on this, and in a nutshell, the new ISV Connect Program provides a 10% revenue sharing fee and additional go-to-market benefits. If you’ll exceed annual revenue of $1.25M, there is a chance to join a Premium tier with an additional 10% revenue sharing fee and more co-selling benefits.

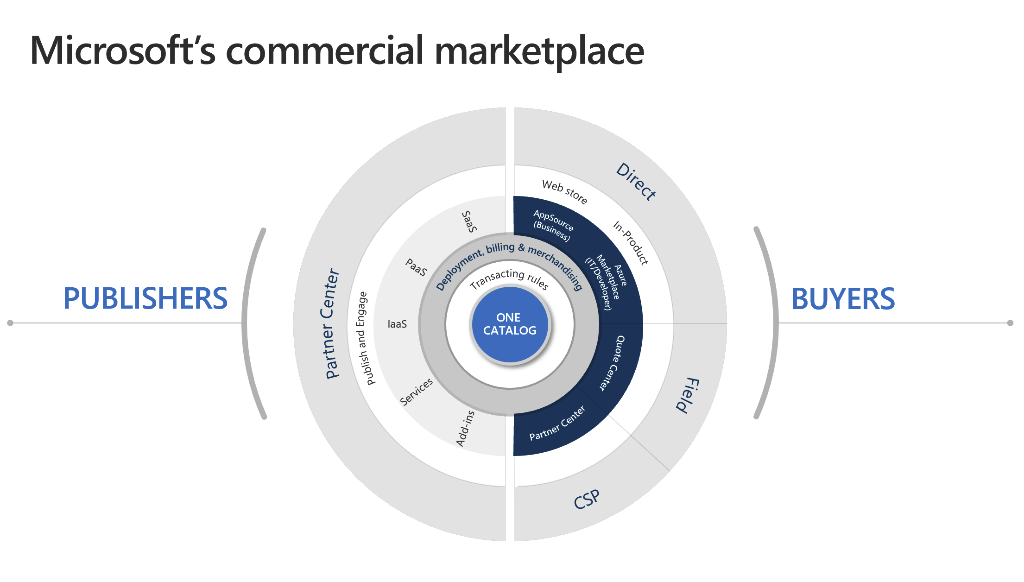

This graphic from Microsoft makes a decent job of explaining the differences between the market places:

(Source)

The program works through AppSource and currently seems to support Dynamics 365 and PowerApps applications. There’s a detailed policy document that outlines all the specifics for this program.

You can access the new partner contract to join the ISV Connect Program here. After this, you can submit your apps.

Looking at the other announcements, a new tool called ISV Studio is launching. Partners can use this to gain access to more insights, such as metrics, app installs, and similar. ISV Studio Preview is available here.

Also, Azure Marketplace and AppSource will receive new capabilities in the future, that allows partners to offer solutions through the CSP program. This allows Microsoft partner companies to provide their services and products globally. Support for Power BI and Office apps will be added soon, also.

Other additions to marketplaces include monthly and annual SaaS billing, more flexible pricing options, and free SaaS trials (freemium, if you will). More details on these can be found here.

My recommendation: Double down on Power Platform, as it’s becoming a core and fundamental platform for all Business Applications in the Microsoft realm. The ISV Connect Program looks promising, mainly because of more access to customers through the AppSource channel. I’m not entirely confident whether the numerous marketplaces Microsoft currently has, are all good enough or if they’ve found their audience yet. Even still, packaging and selling PowerApps and Dynamics 365 focused solutions is undoubtedly an exciting proposition for many partners.

Co-selling with Microsoft

I’d heard Microsoft employees mention IP co-selling numerous times in the past, and during Inspire, more details were revealed on this fiscal’s targets. Co-selling is a program that rewards (= more money) Microsoft sellers for selling third-party (partner) solutions. In essence, partners can have their solutions to be sold by the Microsoft sales force.

IP co-selling then is for packaged third-party solutions that are hosted on Azure or Dynamics 365. It’s more akin to apps than services. The difference being that co-selling can include solutions, apps, and services that can be packaged.

Requirements for IP co-selling are listed here. A more in-depth session on IP co-selling is available here.

My recommendation: Partners should aim for co-selling, especially IP co-selling. The requirements are precise yet not easily achieved. Case studies become essential, as well as defining a clear target audience. Collaboration and communications with Microsoft are mandatory and crucial, as co-selling – by definition – is selling with Microsoft.

AI

AI is, of course, all the rage these days. One of the problems with AI tends to be that the term is thrown around carelessly, and without substance to provide tangible benefits. Microsoft announced the Azure AI Accelerate Program, for which I was unable to find much information beyond the press release. Partners can apply for the program starting July 14.

There’s a recording of a panel discussion from Inspire available here, that touches the AI partner programs. If you skip to the 50-minute mark, it has a few bits more on the Azure AI Accelerate Program:

(Source)

Partners quality based on business, technical, and ethical capabilities and commitment. This is interesting as to how the ethical side might be measured. Benefits include AI co-sell with Microsoft, and the ability to build a better AI portfolio and solutions.

Fifteen partners are part of a strategic AI partnership; you can find them listed here.

My recommendation: Partners have to start building a practice around AI. Not just AI itself, but in weaving AI-enabled solutions as part of products, services, and offerings. Microsoft has a great playbook aimed at partners that assist in planning and building such practice. It isn’t about selling AI in and by itself, but instead benefiting from capabilities from Azure and Office 365, as well as the frameworks available from Microsoft for building AI-based solutions.

Cloud Adoption Framework

Another notable mention from Inspire was the Cloud Adoption Framework for Azure. It’s available here. This is interesting for a multitude of reasons – it’s a framework for both enterprise customers starting their journey with Azure, and it also has excellent guidance for existing Azure deployment partners to fine-tune their deployment and governance models.

It’s in preview for now, but it’s already very comprehensive. If you’re unsure whether the guidance is a good fit, skim through the strategy portion and see for yourself.

My recommendation: For existing MSPs and other partners well versed in Azure, have a look at the framework and see if there are any gaps in your current models. Steal with pride, and benefit from the extensive work Microsoft has done with documenting their battle-hardened framework. Keep what’s working for you, and replace what you feel you can do better for your customers.

Azure Migration

Next, on the list of exciting announcements are the changes for Azure Migration Program and Azure Migration itself.

Azure Migrate was announced in September. It’s a service within Azure that provides guidance and tooling for discovering, assessing, and migrating virtual machines, physical machines, and databases to Azure. The first announcement is around Azure Migration Program, which includes more guidance and role-specific training. It also packs in Azure Cost Management and Azure Migrate, but these have already been available for some time, as well as the Azure Hybrid Benefit and Extended Security Updates offers.

The trainings are based on Cloud Adoption Framework. Partners wanting to be part of the program can join here.

My recommendation: Partners focused on migrations, multi-cloud solutions, and hybrid approaches should immediately join the Azure Migration Program. Also, the new advanced specializations include many migration-focused competencies, that should be a goal for this fiscal year. Cloud Adoption Framework seems to be positioned as key to further extend and broaden business around migration, as it also includes governance aspects.

Microsoft Teams

Microsoft revealed impressive figures from Teams usage, including over 13 million daily active users (DAUs) and 19 million weekly active users (WAUs). It’s been evident during the last fiscal year that Teams gets a lot of funding and muscle from inside Microsoft, and it shows strongly with adoption rates and customer usage.

For Teams, Microsoft announced, that CSPs can provide six-month trials of Teams for customers who are not yet in the cloud or are just using Exchange Online as part of Microsoft 365. This program is available from August 1. Guidance can be found here.

My recommendation: Partners who provide solutions and deployment services around Teams might not benefit too much from the new program, as there are plenty of other services and options to entice customers to start using Teams. The business around deploying Teams for customers might not grow indefinitely, as growth is already strong – but the business of governance, security, end-user training (or adoption) is still going to be healthy and is growing. This is one of the areas partners should look into, and be prepared to package their offerings and services beyond just providing hourly consulting on Teams.

In summary

Inspire 2019 was packed with announcements, and I focused on the ones that were more partner-focused offerings or new opportunities, rather than on technical tidbits. There are still plenty of things to be learned as the session recordings become more widely available.

The roadmap is more or less clear for Microsoft partners for the next 12+ months.